Wills, LPAs and Probate

PRIVATE CLIENT DEPARTMENT

Our team of Lawyers have many years of collective experience in delivering high quality work over a comprehensive range of services including Probate and Estate Administration, Will drafting, Trust creation and administration, Deputyship Orders, tax planning and Powers of Attorney.

Making the best provision for your family for now and in the years to come requires careful planning with help from an experienced and professional Firm of Solicitors. Whether you are seeking to arrange how your Estate should be divided or require advice as to how to mitigate the burden of Inheritance Tax or have recently suffered a bereavement, our team is trained to advise and assist you in all matters associated with Wills, Lasting Powers of Attorney and Probate.

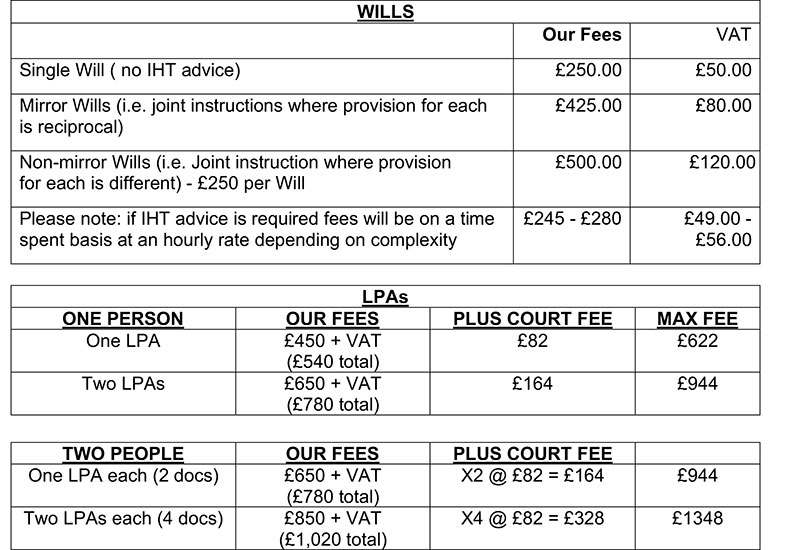

FEES

Further to this fee scale please note more detailed information set out below.

Wills

Our fee for a single standard Will will be £250 plus VAT. Our fee for mirror Wills (i.e. a joint instruction where reciprocal provision is made will be £425 plus VAT.

Our fee will cover taking your instructions, preparing the draft Will, sending the draft Will to you for your approval, drafting any amendments as necessary and attending upon you to explain the terms of the Will and thereafter to deal with its execution.

We will advise you as to the likely inheritance tax consequences of the provisions which you have asked us to include in your Will on the basis of the information which you have given to us. If you require additional advice regarding tax efficiency or on life-time tax planning, then additional fees may arise which we will discuss with you at the time.

These fees assume that no unusual difficulties will be encountered but if the matter proves to be more complex or time consuming than is normally expected our fee may be more. We will explain and agree this with you before proceeding. Additional work will be chargeable at the hourly rate applicable to the relevant Fee Earner dealing with the matter as listed below. You will always be advised of any additional fees before they are incurred and charged to you.

We would normally expect to send out to you a draft copy of a standard Will within seven working days of you providing us with clear instructions. If the instructions are complex or involve complicated drafting it may take a further seven days. This timescale may be extended further if it is necessary to involve a third party such as a doctor to provide a capacity assessment. Once the Will has been approved and you have informed us you are ready to proceed, we would expect to arrange an appointment to deal with the signing of the engrossed Will within a further ten working days.

Lasting Power of Attorney

You may make a Lasting Power of Attorney for financial decisions and/or a separate Lasting Power of Attorney to cover Health & Care decisions. Our fees for Lasting Powers of Attorney for one person whether for Financial or Health & Care Decisions is £450 plus VAT for one or £650 plus VAT for both type.

If a joint instruction from two people our fees would be £650 plus VAT for one type each or £850 plus VAT for both types each.

For each individual LPA submitted there is a Court fee of £82, although a fee remission is possible depending on your financial circumstances. We can explain this to you and assess whether you may be entitled to seek a remission when we meet with you.

The work involved for the above fees cover advising you on LPAs and your options, taking your instructions, preparing draft documents, sending the drafts to you for approval, making any amendments as necessary, attending upon you to explain the terms and effect and thereafter to deal with execution, including acting as a Certificate provider where requested. Where necessary, to prepare the papers to notify any third party as appropriate; apply for registration of each LPA; lodge application papers with the Office of the Public Guardian; confirm once registration completed and supply a certified copy of each registered LPA.

Any additional work will be chargeable at the hourly rate applicable to the relevant Fee Earner dealing with the matter as listed below.

Our experience shows us that realistically the average timescale to lodge a Lasting Power of Attorney for registration is four to eight weeks from the date on which you provide us with sufficient details to draft an LPA until the finalisation of the signing of the LPA. This timescale may be extended if it is necessary to involve a third party such as a doctor to provide an assessment or to act as certificate provider. For the Office of the Public Guardian to register an LPA and return the registered documentation to us takes around eight to ten weeks. The timescale could be extended if there is any objection to the application to register an LPA or an application for an exemption or remission of the registration fee is claimed.

Fees for covering other services, including creation and administration of settlements and Trusts, Living Wills, tax planning and Deputyship applications are available on request by contacting any member of our experienced Departmental Team.

Probate – uncontested cases where all assets are in the UK

We can support you through this difficult process by obtaining the grant of representation on your behalf.

Our fees are based on the amount of time it takes us to apply for the grant of representation and to collect, distribute the estate assets and the seniority and experience of the solicitors and other fee earners working on your matter. The solicitors and other fee earners will be specifically agreed with you at the outset of your matter once we know the details and circumstances involved and will generally cover all of the work required to complete the administration of the estate.

In addition to the above, our fees are also dependent on the specific circumstances of the estate including its size and complexity, and as a result our fees may increase or decrease accordingly. For example, if there is one beneficiary, one bank account and no property, our costs will normally be relatively low. If there are multiple bank accounts, a property and multiple beneficiaries, and if Inheritance Tax is payable, our costs will normally be higher.

Our current charge rates range from £180 for a newly/recently qualified solicitor to £280 for a senior partner/consultant.

Typically the cost of obtaining a grant of representation and administering an uncontested estate consisting only of assets situated in the UK will be between £3,000 and £7,000. We will handle the full process for you. The band of fees set out in this paragraph applies to estates where:

• There is a valid will

• The deceased was domiciled in the UK

• There are no assets outside the UK

• There are no more than three bank or building society accounts

• There is no more than one property

• There are no other intangible assets

• There are no more than five beneficiaries

• There are no disputes between beneficiaries on division of assets. If disputes arise this is likely to lead to an increase in costs

• There is no inheritance tax payable and the executors do not need to submit a full account to HMRC

• There are no claims made against the estate

Disbursements are costs related to your matter that are payable to third parties, such as court fees. We handle the payment of the disbursements on your behalf to ensure a smoother process and these are then added to our invoice. Disbursements are not included in our estimate, however, these normally include:

• Probate application fee of £155 plus £1.50 for each official copy of the grant of representation.

• Bankruptcy-only Land Charges Department searches (£2 per name)

• £100 to £350 for statutory advertisements in the London Gazette and a local newspaper in order to protect the personal representatives against unexpected claims from unknown creditors (the costs of these advertisements may vary depending on the location, publication and the number of advertisements required).

Potential additional costs

• If there is no will and/or the estate consists of any share holdings (stocks and bonds) there are likely to be additional costs that could range significantly depending on the estate and how it is to be dealt with. We can give you a more accurate quote once we have more information.

• Dealing with the sale or transfer of any property in the estate is not included. Information about the property services we offer, together with our fees, is available on our website or upon request.

• Trust administration is not included in this quote, but we can advise on this as appropriate and provide you with a quote.

• If there are non-UK assets there may be additional costs of obtaining advice from foreign counsel and liaising with foreign financial and governmental institutions.

• Disputes arising during the administration of an estate may incur additional costs and we will provide a further estimate as soon as practicable.

VAT

VAT is payable at 20% on all legal fees and taxable disbursements.

How long will this take?

On average, estates that fall within this range are dealt with within six to twelve months. This time frame represents three to six months to obtain the grant of representation, two to three months to collect in assets and one to three months to distribute the assets and generally wind up the administration.

If the administration of the estate is straightforward then the timeframe will likely be at the lower end of these estimates, however, if the estate is substantial in size and complexity then the time frame may be more than these estimates.

As part of our service we will:

• Provide you with a dedicated and experienced probate specialist to work on your matter

• Identify the legally appointed personal representatives and beneficiaries

• Accurately identify the type of grant of representation you will require

• Obtain the relevant documents required to make the application

• Complete the grant of representation application and the relevant HMRC forms

• Draft a Statement of Truth for the executor/s to sign

• Make the application to the District Probate Court on your behalf

• Obtain the grant of representation

• Collect and distribute all assets in the estate

• Prepare detailed estate accounts setting out the sums received and paid out during the course of the administration.

We can also help you if you only want us to obtain a grant of probate using form IHT205

Preparing the Statement of Truth and completing Form IHT205 (based on information provided by you) is charged at a fixed fee dependent on the size and complexity of the estate of £750 - £1,000 plus VAT and disbursements. This fee or retainer does not include the administration of the estate as explained above. Jacobs & Reeves is under no obligation to check the accuracy of the information you provide prior to preparing the Statement of Truth and IHT205. There is a disbursement fee of £155 payable to the Probate Registry on the date the application is made and you would be required to pay this fee (plus the Registry’s additional fee of £1.50 for each sealed copy grant).

LAWYERS

Fiona Kenny

Fiona is a solicitor who specialises in Estate Administration. She qualified as a solicitor in 2006 after completing a Masters Degree in Legal Studies at Bristol University. Fiona has worked in the South of England, including London and joined our Private Client Team in September 2019.

Currently hourly rate £245 + VAT where fixed fees do not apply.

Claire Channer

Claire has been employed at Jacobs & Reeves for over 16 years and has considerable experience in the Private Client Department.

Claire specialises in the preparation of Wills and has prepared a number of complex testamentary provisions to suit the client’s particular needs.

Current Hourly Charging Rate: £180 plus VAT where fixed fees do not apply

%5B1%5D.png)